Check the status of my API here: https://crypto-predictor-app-0947ef5b3b47.herokuapp.com

This is a site my friend and I were working on as I was doing this project. Take a look!

!pip install pandas requests

!pip install matplotlib seaborn

!pip install imbalanced-learn

!pip install ta

import pandas as pd

import requests

import matplotlib.pyplot as plt

import seaborn as sns

from imblearn.over_sampling import SMOTE

import numpy as np

import time

import ta

from ta import add_all_ta_features

from ta.utils import dropna

from sklearn.metrics import accuracy_score, classification_report, roc_auc_score

def get_historical_data(crypto_id, days):

time.sleep(5) # Introducing a delay of 5 seconds between requests

url = f”https://api.coingecko.com/api/v3/coins/{crypto_id}/market_chart?vs_currency=usd&days={days}”

response = requests.get(url)

data = response.json()

# Check if ‘prices’, ‘market_caps’, and ‘total_volumes’ keys exist

if ‘prices’ in data and ‘market_caps’ in data and ‘total_volumes’ in data:

combined_data = [

{

“date”: p[0],

“price”: p[1],

“market_cap”: m[1],

“24h_volume”: v[1]

}

for p, m, v in zip(data[‘prices’], data[‘market_caps’], data[‘total_volumes’])

]

return combined_data

else:

print(f”Error fetching data for {crypto_id}. Response: {data}”)

return []

def get_top_n_coins(n):

url = f”https://api.coingecko.com/api/v3/coins/markets?vs_currency=usd&order=market_cap_desc&limit={n}&sparkline=false&price_change_percentage=false”

response = requests.get(url)

# Check if the response is successful

if response.status_code != 200:

print(f”Error {response.status_code}: {response.text}”)

return []

try:

data = response.json()

return [coin[‘id’] for coin in data]

except (TypeError, KeyError) as e:

print(f”Unexpected response format: {response.text}”)

return []

def get_historical_data_for_coins(coins, days=”90″):

historical_data = {}

for coin in coins:

historical_data[coin] = get_historical_data(coin, days)

return historical_data

def add_indicators(prices):

# Convert to DataFrame

df = pd.DataFrame(prices)

df[“date”] = pd.to_datetime(df[“date”], unit=’ms’) # Convert timestamp to date

df.set_index(“date”, inplace=True)

# Calculate Moving Averages

df[‘1_day_MA’] = df[‘price’].rolling(window=24).mean()

df[‘7_day_MA’] = df[‘price’].rolling(window=7*24).mean()

# Using ta library to add technical indicators

# First drop NaN values

df = dropna(df)

# Adding RSI

df[‘RSI’] = ta.momentum.RSIIndicator(df[‘price’]).rsi()

# Adding MACD and MACD Signal line

MACD = ta.trend.MACD(df[‘price’])

df[‘MACD’] = MACD.macd()

df[‘MACD_signal’] = MACD.macd_signal()

# Adding Bollinger Bands

Bollinger = ta.volatility.BollingerBands(df[‘price’])

df[‘Bollinger_high’] = Bollinger.bollinger_hband()

df[‘Bollinger_low’] = Bollinger.bollinger_lband()

# Adding Market Cap and 24-hour Trading Volume

# Optionally, you can apply scaling or transformations to these features

df[‘market_cap’] = df[‘market_cap’]

df[’24h_volume’] = df[’24h_volume’]

return df

coins = get_top_n_coins(50)

historical_data = get_historical_data_for_coins(coins)

data_with_indicators = {}

for coin, data in historical_data.items():

data_with_indicators[coin] = add_indicators(data)

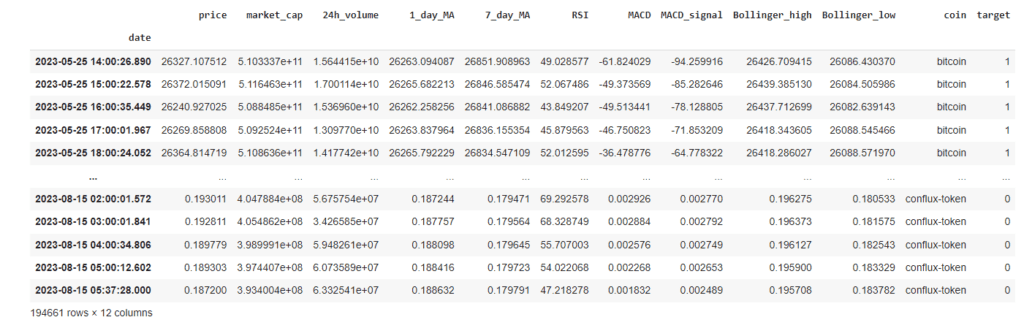

# Create a list to store individual dataframes

df_list = []

for coin, df in data_with_indicators.items():

df[‘coin’] = coin # Add a new column with the coin name (or ID)

df_list.append(df)

# Concatenate all the dataframes in the list into a single dataframe

combined_df = pd.concat(df_list, axis=0)

data = combined_df.dropna()

# Pseudo-code to avoid the SettingWithCopyWarning

# Create a copy of the data

data_copy = data.copy()

# Shift the price column by -1 days

data_copy[‘price_next_week’] = data_copy.groupby(‘coin’)[‘price’].shift(-24) #hourly data

# Create the target variable. 1 if the price increased in the next week, 0 otherwise.

data_copy[‘target’] = (data_copy[‘price_next_week’] > data_copy[‘price’]).astype(int)

# Drop the ‘price_next_week’ column as it’s not needed anymore

data_copy.drop(‘price_next_week’, axis=1, inplace=True)

from sklearn.model_selection import StratifiedShuffleSplit

# 1. Stratified Split

sss = StratifiedShuffleSplit(n_splits=1, test_size=0.3, random_state=42) # 70% training, 30% for validation+test

# This will give indices for training and (validation+test) sets, preserving the distribution of coins

for train_idx, temp_idx in sss.split(data_copy, data_copy[‘coin’]):

train_data = data_copy.iloc[train_idx]

temp_data = data_copy.iloc[temp_idx]

# Now, split the temp_data into validation and test datasets (50-50 split)

valid_data = temp_data.sample(frac=0.5, random_state=42)

test_data = temp_data.drop(valid_data.index)

# 2. One-Hot Encoding

train_data = pd.get_dummies(train_data, columns=[‘coin’])

valid_data = pd.get_dummies(valid_data, columns=[‘coin’])

test_data = pd.get_dummies(test_data, columns=[‘coin’])

# 3. Data Preparation

X_train = train_data.drop(‘target’, axis=1)

y_train = train_data[‘target’]

X_valid = valid_data.drop(‘target’, axis=1)

y_valid = valid_data[‘target’]

from sklearn.ensemble import RandomForestClassifier

# 4. Model Initialization

rf_model = RandomForestClassifier(n_estimators=100, random_state=42)

# 5. Training

rf_model.fit(X_train, y_train)

# 6. Validation

y_pred_rf = rf_model.predict(X_valid)

accuracy_rf = accuracy_score(y_valid, y_pred_rf)

roc_auc_rf = roc_auc_score(y_valid, y_pred_rf)

report_rf = classification_report(y_valid, y_pred_rf)

print(f”Accuracy (Random Forest): {accuracy_rf}”)

print(f”ROC-AUC (Random Forest): {roc_auc_rf}”)

print(“Classification Report (Random Forest):”)

print(report_rf)

# 7. Preparation

X_test = test_data.drop(‘target’, axis=1)

y_test = test_data[‘target’]

# 8. Prediction

y_pred_test = rf_model.predict(X_test)

# 9. Evaluation

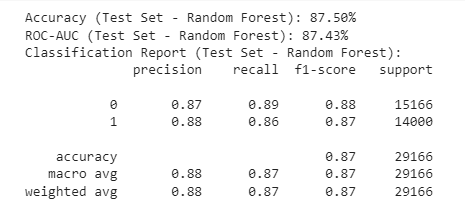

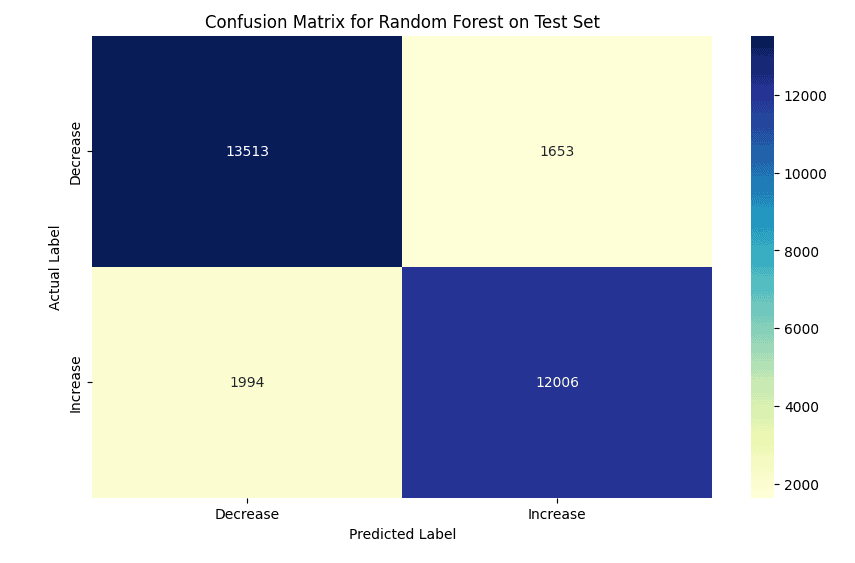

accuracy_test = accuracy_score(y_test, y_pred_test)

roc_auc_test = roc_auc_score(y_test, y_pred_test)

report_test = classification_report(y_test, y_pred_test)

print(f”Accuracy (Test Set – Random Forest): {accuracy_test*100:.2f}%”)

print(f”ROC-AUC (Test Set – Random Forest): {roc_auc_test*100:.2f}%”)

print(“Classification Report (Test Set – Random Forest):”)

print(report_test)